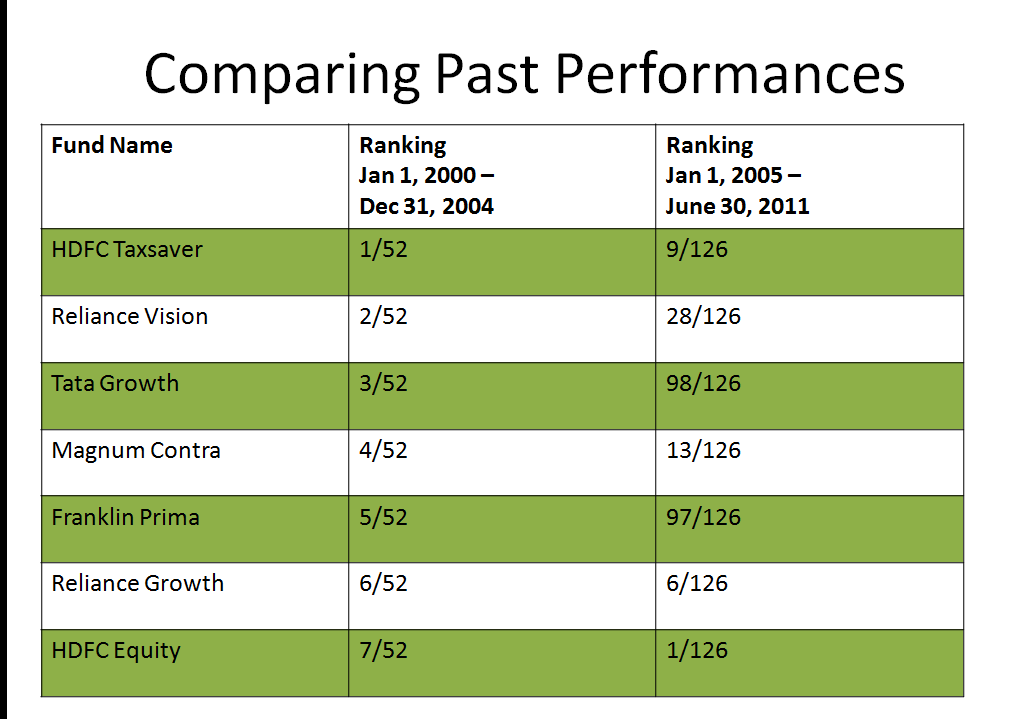

Mr. Harish Rao: I have taken two scenarios: An investor looks at performance for a 5 year period (from Jan 2000 through Dec 2004) and then decides to invest in the start of a new bull market from Jan 2005.

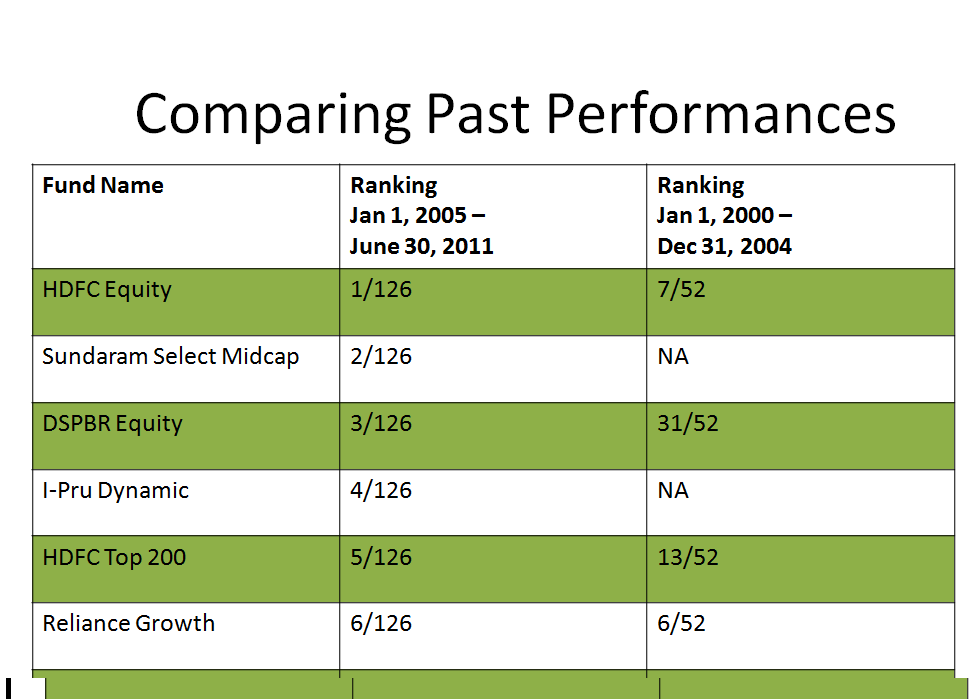

Also I have seen what sort of a performance did the really good performers in the period Jan 2005 – June 2011 have in the previous five years.

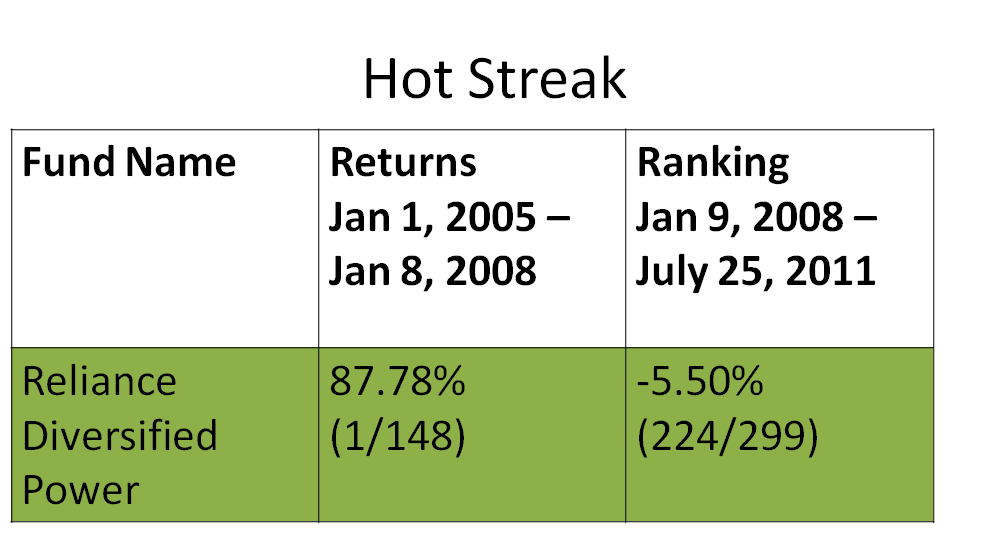

In the third slide, I have tried to highlight the peril of chasing a fad (however good performing). I have considered Reliance Diversified Power Fund. Most of the inflows came on the back of strong performance and then stayed to suffer a down turn. I also use this slide to recommend against thematic and sectoral funds.

The Research is conducted by Mr. Harish Rao, Money Management Coach, Simple Equation, Bangalore.